Bangkok Post – Thailand tightens mobile banking transfer limits

B50,000 daily cap for children and elderly opening new accounts part of fraud-protection policy

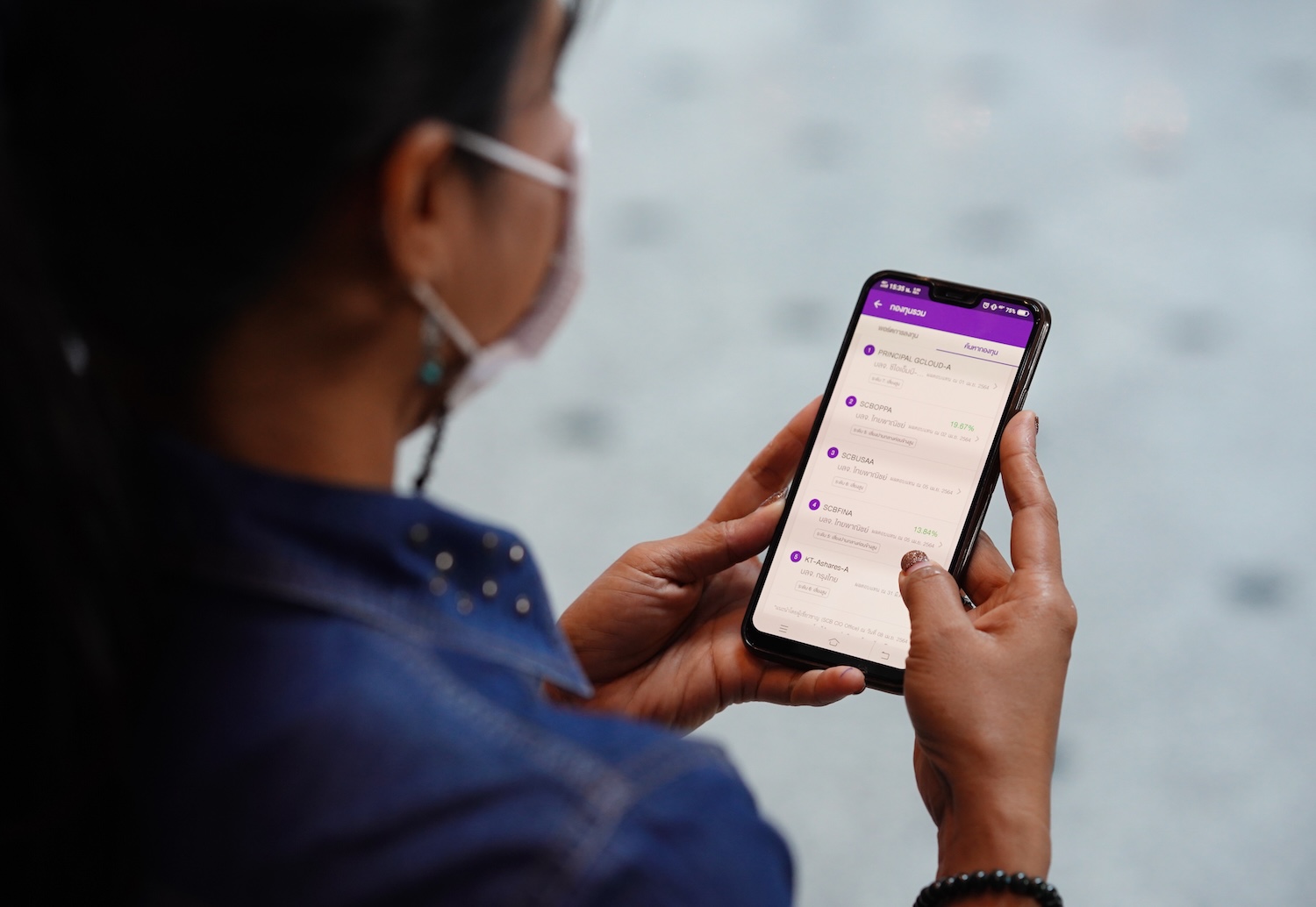

The Bank of Thailand has set a daily transfer limit of 50,000 baht for children and the elderly using mobile banking, seeking to curb financial fraud.

The new customer profiling system will set transfer limits based on the risk profile of each customer segment, said Daranee Saeju, assistant governor for payment systems policy and financial consumer protection.

It divides mobile banking users into three groups: suspected fraudsters, general users and vulnerable customers. Vulnerable customers include those under 15 years of age and over 65.

Daily transfer limits are categorised into three tiers: under 50,000 baht (S), under 200,000 baht (M) and above 200,000 baht (L). The limit assigned depends on the customer’s risk profile and each bank’s know-your-customer (KYC) assessment.

Ms Daranee said the measure has already been applied to new mobile banking applicants, while existing users must gradually comply by the end of this year.

Nevertheless, each bank will determine customer risk classifications based on its own considerations, and customers with good financial records will not be affected.

“The transfer limit depends on customers’ financial behaviour,” said Ms Daranee. “For example, banks may start with lower limits for new or inactive clients. Meanwhile, regular customers can continue transactions as usual.”

Customers seeking higher transfer limits can request an upgrade from their banks. However, the central bank requires banks to pay special attention to vulnerable groups, as they are more susceptible to fraud.

Thailand has around 12 million mobile banking users. Existing central bank safeguards cap mobile banking transfers at 50,000 baht per transaction (with facial recognition required) and 200,000 baht per day in total.

Financial fraud remains a serious concern, said Ms Daranee. In June alone, 24,500 scam cases related to money transfers were reported, causing total losses of 2.8 billion baht — an average of 114,000 baht per case. The largest single fraudulent transfer amounted to 4.9 million baht, according to the central bank.

Across the region, victims who transferred more than 50,000 baht per transaction to mule accounts accounted for the largest share of fraud cases at 22%, but made up as much as 76% of total losses.

On average, scammers needed only three minutes to siphon off half of the stolen funds, while victims typically took 19–25 hours to report the fraud.

For the first six months of this year, children under 15 were involved in 78,468 financial scam cases, while victims over 65 accounted for 416,453 cases.

No Comment! Be the first one.