How to spot an ATM skimming device and protect yourself from fraud

As financial fraud continues to evolve, officials are urging the public to take precautions against a growing threat: ATM skimming.

ATM skimming devices are designed to secretly capture a user’s card data and personal identification number (PIN), often without the victim realizing it until unauthorized transactions appear. Criminals use sophisticated technology to make these devices blend in seamlessly with legitimate parts of the ATM, making them difficult to detect.

How can you spot the signs of ATM skimming?

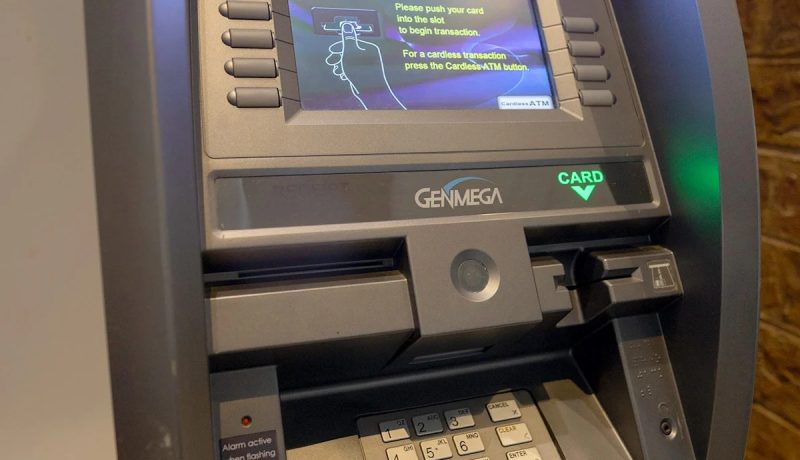

According to banking and cybersecurity officials, users should carefully inspect any ATM before use. One of the most common red flags is a loose or bulky card reader. If the card slot appears misaligned, has adhesive residue, or protrudes more than usual, it may house a skimming device. Customers should perform a “wiggle test,” gently shaking the reader to check for movement.

The keypad is another area of concern. Fraudsters may place a fake keypad over the original to record keystrokes. Signs of tampering include a raised or unusually stiff keypad, mismatched materials, or a loose fit. Experts recommend pulling gently at the keypad edges to ensure it’s securely attached.

In addition to skimmers and overlay keypads, criminals often install tiny pinhole cameras near the ATM to film users entering their PINs. These cameras may be disguised as brochure holders, mirror screws, or light panels. Consumers are urged to cover the keypad with one hand while entering their PIN.

Other telltale signs of tampering include loose wires, misaligned seams, and unusual prompts asking for a PIN to be entered multiple times. In some cases, the entire front of an ATM may be replaced with a counterfeit panel designed to steal information.

What preventive measures can you take to avoid ATM skimming?

To reduce risk, it is recommended to use ATMs located inside bank branches or high-traffic areas with surveillance, rather than standalone machines. Chip-enabled or contactless payment methods offer greater security than magnetic stripe cards.

Customers are also advised to monitor their bank accounts regularly and report any suspicious activity to their financial institution. Prompt reporting can help limit losses and aid investigations.

This article originally appeared on NorthJersey.com: ATM card skimming device warning signs and how to spot fraud

No Comment! Be the first one.